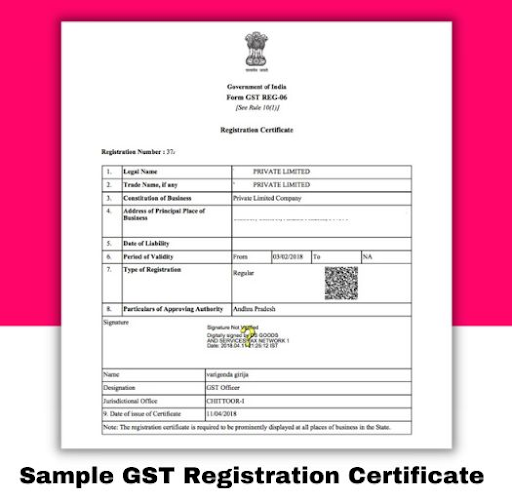

A GST certificate is a legal document issued to taxpayers who successfully register under the Goods and Services Tax system. It serves as proof of GST registration and is issued in Form GST REG-06.

The GST certificate is mandatory for all entities that meet the GST registration threshold or those opting for voluntary registration. This certificate contains the GST Identification Number (GSTIN), legal name, trade name, GST type, date of registration, and address of the principal place of business.

Businesses must display the GST certificate prominently at their place of work as failure to do so might lead to penalties. The certificate can only be downloaded from the GST portal, and there is no physical delivery involved.

Types of GST in India

Before discussing the GST certificate download, it is vital to understand the types of GST applicable in India. GST is categorized into four broad types to ensure clarity and smooth taxation at various levels:

1. Central Goods and Services Tax (CGST)

CGST is levied by the central government on intra-state transactions of goods and services. It applies when the buyer and seller are within the same state. For instance, if a business operates and transacts within Maharashtra, CGST will apply.

2. State Goods and Services Tax (SGST)

SGST is levied by the state government and is also applicable to intra-state sales. CGST and SGST are charged in equal proportions. For example, if the total GST rate is 18%, 9% will be CGST, and the remaining 9% will be SGST.

3. Integrated Goods and Services Tax (IGST)

IGST is applicable on inter-state supplies of goods or services or imports. It is collected by the central government and later shared with the respective state. For example, if a business in Delhi sells goods to another business in Tamil Nadu, IGST will be charged.

4. Union Territory Goods and Services Tax (UTGST)

UTGST is applicable for transactions taking place in Union Territories, such as Chandigarh, Lakshadweep, Andaman and Nicobar Islands, and others. Similar to SGST, UTGST is charged alongside CGST for intra-Union Territory transactions.

How to Download GST Certificate?

The GST certificate download process is straightforward and user-friendly. Here’s how you can download your GST certificate in a few easy steps:

Step 1: Visit the GST Portal

Go to the official GST portal at www.gst.gov.in. This website is the central platform for all GST-related activities, including registration, return filing, and certificate download.

Step 2: Login to the GST Portal

– Click on the ‘Login’ button located in the top-right corner of the home page.

– Enter your registered username and password to access your GST account.

– Once logged in, you’ll see your basic account dashboard.

Step 3: Navigate to the Certificate Section

– On the dashboard, locate the ‘Services’ tab in the top menu.

– Under ‘Services,’ hover over the option ‘User Services.’

– Select ‘View/Download Certificates’ from the dropdown menu.

Step 4: Download GST Registration Certificate

– In the ‘Certificates’ section, you will see a link labeled ‘Download GST Registration Certificate.’

– Click on the download link.

– Your GST certificate will be downloaded in PDF format.

Step 5: Save and Print Your Certificate

Once downloaded, save the GST certificate securely on your device. If needed, you can print a hard copy to display it at your place of business, as mandated by GST regulations.

Details Included in Your GST Certificate

The GST certificate you download will contain the following vital details:

- GSTIN (15-digit unique GST Identification Number)

- Legal name and trade name of the business entity

- Constitution of the business (e.g., proprietorship, partnership, LLP, or company)

- Type of GST applicable (CGST, SGST, IGST, UTGST)

- Principal and additional places of business

- Date of GST registration

- Validity period (for temporary registrations)

Ensure you cross-verify the details in your certificate. In case of discrepancies, you may need to apply for rectification or amendments via the GST portal.

GST Certificate Download Based on GST Type

Each type of GST—CGST, SGST, IGST, and UTGST—requires businesses to follow compliance regulations. However, the process for downloading the GST certificate remains the same across GST types. The GST system is integrated, meaning the certificate issued on the GST portal will reflect the type of GST applicable to your business.

For example:

- A business operating solely within a state will see SGST and CGST details.

- A company with inter-state transactions will have IGST indicated on its certificate.

Make sure to review your GST registration type to confirm which tax types you have opted for, as it reflects on your certificate.

Revisiting GST Certificate Download Scenarios

Here are some common GST certificate download scenarios based on business types and GST applicability:

Scenario 1: Intra-State Business (CGST + SGST)

– If your business operates within the boundaries of a single state, the certificate will reflect both CGST and SGST.

– To download this certificate, follow the general GST certificate download steps as outlined above.

Scenario 2: Inter-State Business (IGST)

– Businesses involved in inter-state trade or commerce will see IGST mentioned on their certificate.

– The download process remains identical. Simply log in to your GST portal account and access the certificate.

Scenario 3: Union Territory Businesses (UTGST)

– Businesses located in Union Territories must comply with UTGST rules.

– After registering for GST on the portal, you can download the certificate reflecting the UTGST components.

Scenario 4: Exporters and Importers

– Exporters and importers typically deal with IGST due to international trade.

– The downloadable GST certificate will list IGST compliance for such businesses.

Scenario 5: E-Commerce and Online Platforms

– E-commerce operators and aggregators often show a combination of CGST, SGST, or IGST on their GST certificate, depending on transaction locations.

– Any e-commerce business can download its GST certificate by accessing its GSTIN profile on the portal.

Troubleshooting GST Certificate Download Issues

In some cases, businesses may face problems downloading their GST certificate due to technical, login, or documentation discrepancies. Here are common issues and solutions:

1. Incorrect GSTIN or Login Credentials

– Ensure the correct GSTIN, username, and password details are entered.

– Use the ‘Forgot Password’ option if you are unable to log in.

2. Pending Registration Approval

GST registration must be approved by the tax authority before the certificate becomes available. If your application is still under process, wait for its approval.

3. Issues in GST Details

Discrepancies in your GST application might lead to certificate unavailability. Edit the application details and resubmit if required.

4. Portal Errors or Downtime

If the GST portal is experiencing downtime, wait for some time and retry logging in. You may also clear your browser cache or try a different browser.

Conclusion

Downloading a GST certificate is an integral part of GST compliance for all registered taxpayers. Whether you deal with CGST, SGST, IGST, or UTGST, the step-by-step process remains simple and user-friendly. By following the outlined steps in this article, you can quickly download your GST certificate and ensure compliance with India’s tax laws.

Remember to keep your certificate handy as proof of GST registration and update it periodically to reflect any amendments. Whether you run an intra-state business or operate across Union Territories, procuring and maintaining a valid GST registration certificate is indispensable.

By understanding the types of GST and their implications on your business, you will be better equipped to stay compliant and avoid unnecessary penalties. So, log in today and complete your GST certificate download process to ensure your business operates seamlessly under the GST regime!

FAQscertificate

1. Can I download a physical copy of the GST certificate?

The GST certificate is only available for download in PDF format. You can print a hard copy if required.

2. Is there a fee for downloading the GST certificate?

No, downloading the GST certificate from the GST portal is free of cost.

3. What should I do if my certificate has incorrect details?

You can file for an amendment to correct the details via the GST portal under the ‘Services > Registration’ section.

4. How often should the GST certificate be renewed?

Generally, GST certificates are valid until canceled. However, for casual taxpayers or temporary registrations, the certificate has a validity period.